Long Run Phillips Curve And Rational Expectations –

The viewpoint about inflation and unemployment put forward by Rational Expectations Theory which is the cornerstone of recently developed macroeconomic theory, popularly called new classical macroeconomics.

Friedman’s adaptive expectations theory assumes that nominal wages lag behind changes in the price level. This lag in the adjustment of nominal wages to the price level brings about rise in business profits which induces the firms to expand output and employment in the short run and leads to the reduction in unemployment rate below the natural rate.

But, according to the Rational Expectations Theory, which is another version of natural unemployment rate theory, there is no lag in the adjustment of nominal wages consequent to the rise in the price level. The advocates of this theory argue that nominal wages are quickly adjusted to any expected changes in the price level so that there does not exist the type of Phillips curve that shows trade-off between rates of inflation and unemployment.

According to them, as a result of increase in aggregate demand, there is no reduction in unemployment rate. The rate of inflation resulting from increase in aggregate demand is fully and correctly anticipated by workers and business firms and get completely and quickly incorporated into the wage agreements resulting in higher prices of products.

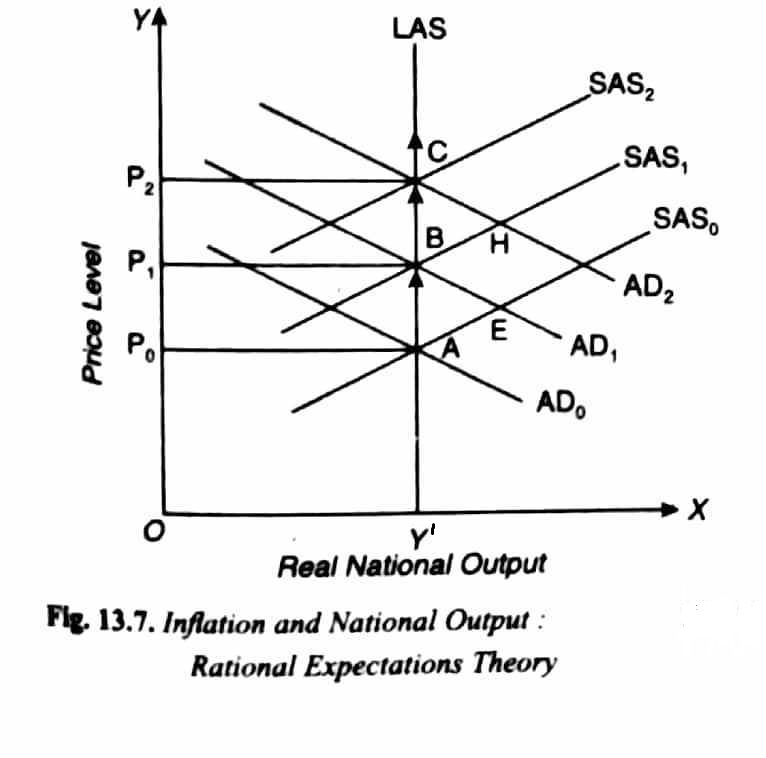

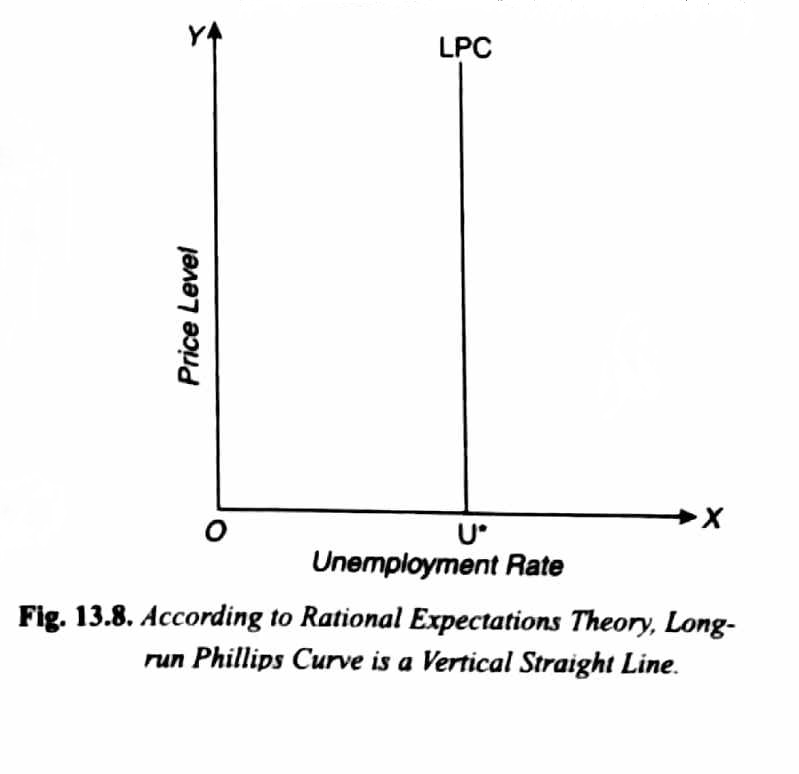

As shown in fig. 13.7, it is the price level that rises, the level of real output and employment remaining unchanged at the natural level. According to the rations expectations theory, aggregate supply curve is a vertical straight line at the potential GNP level (that is, at the natural rate of unemployment, given the resources and technology. Long run Phillips curve, according to rational expectations theory, corresponds to the long run aggregate supply curve and is a vertical straight line at the natural rate of unemployment as shown in fig. 13.8.

Rational Expectations Theory rests on two basic elements. First, according to it, workers and producers being quite rational have a correct understanding of the economy and therefore correctly anticipate the effects of the government’s economic policies using all the available relevant information. On the basis of these anticipations of the effects of economic events and government’s policies they take correct decisions to promote their own interests.

Second is that, like classical economists, it assumes that all product and factor markets are highly competitive. As a result, wages and product prices are highly flexible and therefore can quickly change upward and downward. The rational expectations theory considers that new information is quickly assimilated (taken into account) in the demand and supply curves of markets so that new equilibrium prices immediately adjust to the new economic events and policies.

Fig. 13.7 shows the standpoint of rational expectations theory about the relation between inflation and unemployment. In this OY’ is the level of real potential output corresponding to the full employment of lab our (with a given natural rate of unemployment). LAS is the aggregate supply curve at OY’ level of real potential long run output. AD0 is the aggregate demand curve which intersects the aggregate supply curve LAS at point A and determines price level equal to P0 and SAS0 is the short run aggregate supply curve.

Suppose government adopts an expansionary monetary policy to increase output and employment. As a consequence, aggregate demand curve shifts upward to the new position AD1.

According to rational expectations theory, people will correctly anticipate that this expansionary policy will cause inflation in the economy and they would take prompt measures to protect themselves against this inflation. Accordingly, workers would press for higher wages and get it, businessmen would raise the prices of their products, lenders would hike their rates of interest. All these increases would take place immediately. It is clear that the increase in aggregate demand brought about by expansionary monetary policy will cause the equilibrium to shift to point B and price level will rise to P1. The increase in aggregate demand or expenditure will be fully reflected in higher wages, higher interest rates and product prices, all of which will rise in proportion to the anticipated rate of inflation. Consequently, the levels of real national product, real wage rate, real interest rate, would remain unchanged.

In rational expectations theory the economy does not move temporarily from macro equilibrium at A to E in the short run along the short run aggregate supply curve SAS0. When aggregate demand shifts from AD0 to AD1 short run supply curve shifts immediately from SAS0 to SAS1 as a result of immediate and quick adjustment in wages and other input prices due to correct anticipation of rate of inflation. Similarly, when aggregate demand curve shifts rightward from AD1 to AD2 as a consequence of expansionary monetary or fiscal policy of government, the workers and other input suppliers will correctly anticipate the further rise in price level and will make quickly further forward adjustment in prices. And again due to correct anticipation of the rate of inflation, the rise in wages and in other input prices will be in proportion to the rate of inflation. As a result, short run aggregate supply curve immediately shifts from SAS1 to SAS2 and price level rises to P2 corresponding to the new equilibrium point C.

People’s anticipations or expectations of inflation and acting upon them in their decision making when expansionary monetary policy is adopted frustrate or nullify the intended effect (increase in real output and employment) of government’s monetary policy.

In other words, according to the rational expectations theory, the intended effect of expansionary monetary policy on investment, real output and employment does not materialize. It is due to the anticipation of inflation by the people and quick upward adjustment made in wages, interest etc., by them that the price level instantly rises from P0 to P1 and from P1 to P2, the level of output OY remaining constant. That is why, according to the rational expectations theory, aggregate supply curve is a vertical straight line.

The vertical aggregate supply curve means that there is no trade-off between inflation and unemployment, that is, downward sloping Phillips curve does not exist. So, according to the rational expectations theory, the increase in aggregate demand or expenditure as a consequence of easy monetary policy of the government will fail to reduce unemployment and instead will only cause inflation in the economy.

It is important to note that according to rational expectations theory long run aggregate supply curve is a vertical straight line at potential GNP level such as LAS in fig. 13.7. This is due to the correct anticipation of rate of inflation by the workers and other suppliers of the inputs. If inflation rate was more than the expected or anticipated rate, the unemployment rate would have fallen below the natural level and GNP would have been greater than the potential level.

Since according to rational expectations theory aggregate supply curve LAS is vertical in the long run, the long run Phillips curve is also vertical at the natural unemployment rate.

The long run Phillips curve shows relationship between inflation and unemployment when the actual inflation rate equals the anticipated inflation rate.

The vertical long run Phillips curve shows that whatever the anticipated inflation rate, the long run equilibrium is at the natural unemployment rate.